4 Smart Technologies that Accelerate Patient Billing and Payment

April 24, 2013 •Brian Watson

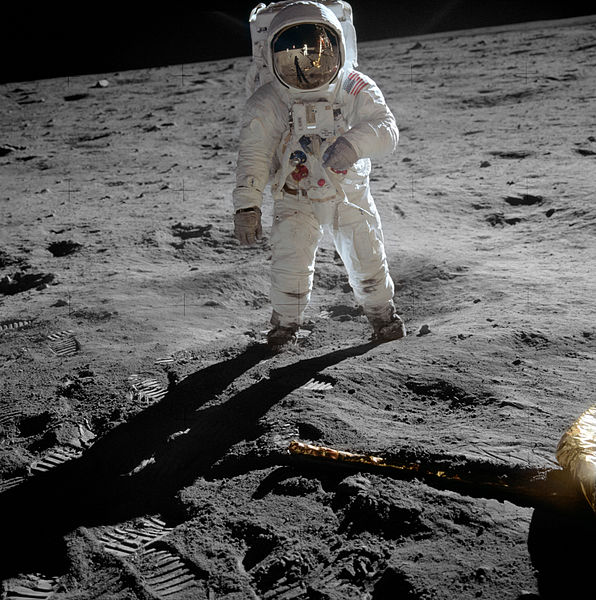

On July 20, 1969, the Apollo Guidance Computer (ACG) and an IBM-developed computer mainframe were used to help Neil Armstrong and Buzz Aldrin complete the still-awe-inspiring-feat of traveling 356,000 km from the earth to the surface of the moon.

And nearly 45 years later, the technology that fueled the space race pales in comparison to the kind of cheap tchotchke you might pick up at your next trade show.

The ACG is no more powerful than most modern pocket calculators. And the IBM System/360 Model 75 had less storage capacity than a run of the mill USB memory stick.

I’ll admit, I think that factoid is utterly fascinating. That two men traveled across the cosmos in a spacecraft powered by a technology that you can easily pick-up for less than $20 at your local Radio Shack is hard to even fathom. (Your mileage may vary, of course).

But what exactly does it have to do with patient billing and payment?

Well, for starters, it’s a good reminder of just how fast technology changes and improves. Think about how much your revenue cycle has transformed in the last 10 or 15 years. Today’s iteration features tools that are way beyond what was best-of-breed even a decade ago.

To consistently be the best – in that 90th percentile of performance of revenue cycle performance – you’re going to have to work at it. Today’s engineering marvel is tomorrow’s quant gadgetry, after all. To stay optimized, you need to explore new ideas. Check out your peers for best-practices. And stay on top of emerging tech.

In this post, I’ll be profiling four smart tools - of varying complexity and cost - that can help you accelerate billing and payment and better respond to the demands of today’s tricky financial environment.

Online Scheduling

Alright, so scheduling may not exactly seem like the most time-consuming process in the world. Booking an appointment over the phone is a pretty fast and straightforward activity - for both your patients and support staff.

But the time it takes to get patients scheduled can add up quickly. For example, say you facility booked 75 new phone-in patient appointments during its office hours today. And that completing each call took an average of 3 minutes. Not an especially daunting number, right?

But consider the aggregate: that’s 225 minutes – or nearly four hours - your staff just spent on the phone arranging appointments with patients. More to the point, it’s nearly four hours of all-important employee productivity that could be better served on coding, charge entry or other key billing tasks.

All the more reason to move the process online. Scheduling performed via a web-based system not only saves staff productivity and reduces costs on the front-end, but also enables simple, single-click registration when a patient arrives for their appointment (thanks to built-in integration between scheduling software and your legacy system).

And it’s a better system for patients, too. Not only do they avoid lengthy phone wait times, they also get the convenience of 24-hour accessibility, too; a big advantage for people that have money-generating responsibilities (i.e. jobs) that typically span normal business hours.

Automated Reminders

Patient no-shows are a really-frustrating fact of life for healthcare providers. According to informal data collected by the MGMA, the national rate for health appointment no-shows averages between 5 and 7%.

Remember those 75 hypothetical appointments that your staff booked earlier? Research suggests five (or more) of them will probably blow off the appointment they just scheduled.

Needless to say, that’s not good for clinical operations. Potential revenue is lost. Patients that are in need of treatment miss the opportunity to see your doctors. And – as a preventative measure – your staff is forced to spend their valuable time (and your organization’s resources) completing the slow, tedious process of manually reaching-out to patients to remind them of their appointments.

Reminding patients about appointments using automated messaging probably won’t totally stem the tide of no-shows. But it can go a long way toward ensuring that your message gets in front of patients at the right time, via the right channel. And that your staff doesn’t have to spend their productivity spearheading the process.

To help ensure that your automated reminder system is a success, I recommend:

• Offering patients several different message delivery channels at appointment scheduling. Some patients are glued to the hip (almost literally) with their smartphone. Others still prefer landlines. Or texts. Or an email alert. Give patients the option to choose from automated IVR (voice), email or SMS text message channels.

• Creating a multi-touch reminder system that sends patients an alert several weeks prior to their appointment and then delivers an additional follow-up 48 hours out.

• Integrating your auto reminder system with your online scheduling application to ensure that data is synched each time a patient books an appointment.

Online Insurance Verification

The best way to ensure that a patient’s payment obligation doesn’t eventually become bad debt is by moving as much of the discussion about financial responsibility and payment terms to the front of the revenue cycle as possible, before treatment takes place.

But that’s no small task. After all, it wasn’t that long ago that financial outreach and discussion of payment options and obligations were activities strictly reserved for the back-end revenue cycle operations – after the patient had received treatment, been sent at least one bill (and maybe several), and had still not yet paid.

Making the move to a more proactive, front-of-cycle financial approach takes a change in processes, philosophy and – last but certainly not least – an upgrade in technology. Providers need tools that speed process, reduce human errors and make patient data accessible and actionable.

Insurance verification is a great example of the impact emerging technology can have on today’s revenue cycle.

Until recently, verification was time-intensive, hands-on and difficult to complete prior to the patient’s visit. But with online verification, employees can now check insurance eligibility and patient demographic information automatically – using specialized online software - prior to the encounter.

Some systems are even taking verification to the next level, plugging CPT codes and insurance eligibility information into online estimation software to determine financial responsibility for a procedure. The resulting data presents co-pay and co-insurance obligations alongside the patient’s outstanding balance or collection amounts that can be collected before a service is preformed, while the remaining balance is due at a later date.

It’s a major win-win. Patients avoid the sticker shock associated with a major unexpected cost on their initial bill. And providers recoup more cash flow on the front-end and stem bad debt on the back.

Online Billing and Payment

Online billing and payment is a crucial part of today’s refreshed, reinvented healthcare revenue cycle.

With bad debt soaring and more patients becoming responsible for their financial obligation, the value proposition of EBPP is clear: it’s faster, less resource-intensive and more efficient than traditional paper statement print and mail practices.

Online billing and payment applications provide an always-on convenience that lets patients pay from pretty much anywhere with an Internet connection, at any time. Making an online payment is fast and simple and funds are automatically routed to your bank account after clearing. And there’s no statement printing and mailing or payment remittance to slow the whole process down.

Those are the overt benefits of EBPP. Through automation and real-time connectivity, online bill presentment and payment technology helps accelerate cash flow, lower collection costs and reduce bad debt.

What’s a little more under-the-radar is its ability to act as a hub for patients to access financial tools, documents and information; supporting the processes I mentioned in this article’s first three sections.

For example, many of today’s best-class online billing and payment platforms have patient scheduling, notification and cost estimation tools built-in out of the box.

So patients can manage their entire financial encounter with a practice via their EBPP portal: scheduling an appointment, selecting how they’d like to be reminded when the encounter approaches, estimating their own cost of treatment (based upon insurance info and common CPT codes), checking financial resources, FAQs and assistance requirements, and viewing/paying their bill online.

What billing technology are you using to improve the productivity of your revenue cycle?

Image Credit: NASA

Get Updates

Featured Articles

Categories

- Charity Care Management (1)

- Compliance (2)

- Customer Service (8)

- Digital Front Door (1)

- Direct Mail (6)

- eBilling (1)

- EBPP (34)

- ESL Statement (2)

- eStatement (1)

- Healthcare Channel Partner Billing (1)

- IVR (3)

- Mobile Payment (11)

- Online Billing and Payment (6)

- Online Patient Payment (17)

- Outsource Print Management (4)

- Paperless Billing (4)

- Patient Engagement (2)

- Patient Friendly Billing (21)

- Print and Mail (7)

- QR Codes (1)

- Quick Pay (7)

- Security (1)

- Self-Pay Patients (9)

- Self-Pay Revenue (4)

- Statement Design (32)

- Statement Print and Mail (1)

- Statement Printing and Mailing (28)

- Statement Processing (36)

- TransPromo (1)

- Up-Front Billing (1)